| |||||

| |||||

| |||||

| Preliminary Proxy Statement | ||||

| Confidential, for Use of the Commission Only (as permitted by Rule | ||||

| Definitive Proxy Statement | ||||

| Definitive Additional Materials | ||||

| Soliciting Material under | ||||

Everi Holdings Inc. | |||

(Name of Registrant as Specified | |||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

| x | No fee required | ||||||||||

| |||||||||||

|

| ||||||||||

| Fee computed on table below per Exchange Act Rules | ||||||||||

(1) | Title of each class of securities to which transaction applies: | ||||||||||

| (2) | |||||||||||

| Aggregate number of securities to which transaction applies: | ||||||||||

| (3) | |||||||||||

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule | ||||||||||

| (4) | |||||||||||

| Proposed maximum aggregate value of transaction: | ||||||||||

| (5) | |||||||||||

| Total fee paid: | ||||||||||

| o | |||||||||||

| Fee paid previously with preliminary | ||||||||||

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||||||||

(1) | Amount Previously Paid: | ||||||||||

| (2) | |||||||||||

| Form, Schedule or Registration Statement No.: | ||||||||||

| (3) | Filing Party: | ||||||||||

|

| Date Filed: | |||||||||

Everi had an outstanding 2019. We continued our progress in operating our business more efficiently and effectively, conserving our resources, and improving our overall financial returns. Yet, in a few short months, the successful execution of our strategic initiatives in 2019 is no longer top of mind. The world has now turned its attention to the novel COVID-19 pandemic, and we are focused on addressing its impact on our employees and their families, our Company and our customers, the gaming industry and the broader economy. The cumulative team effort that achieved revenue growth, increased earnings per share, and lower debt in 2019 positioned us to immediately address challenges posed by the spread of COVID-19 and the closing of all of our customers’ casinos. In the first quarter of 2020, to improve our cash liquidity, we borrowed an additional $125 million after drawing from our existing credit facility. These resources and other cost-saving measures should help us respond to the continuing and changing impacts of the pandemic on our customers and operations. | 2019 Financial Highlights Revenues Grew 14% to $533.2 million EPS Increased 24% to $0.21 per share | |||||

As we navigate the significant adverse effects of the current pandemic on Everi, our first priority is to maintain the health and welfare of our employees, our customers and their guests while maintaining a focus on the long-term success and health of our Company. In these uncertain times, we are focused on what we can control, while keeping an eye on what is developing on the horizon. We believe our FinTech cash access, compliance, and player-loyalty solutions are mission critical elements for our customers as they prepare to reopen for business. Products and services, such as our QuikTicket™ cashless alternative, our digital wallet application, and player-loyalty promotional and self-service enrollment kiosks enable our customers to provide contactless solutions and operate more cost efficiently, even as they help drive revenue. In our Games business, our premium and standard slot offerings are among the industry’s most player-popular and performance-focused products, which we expect will help drive customer revenue and contribute to the overall recovery of the gaming industry. |

|

2019 Product Highlights Annual Gaming and Technology Awards from Global Gaming Business: Smokin’ Hot Stuff Wicked Wheel™ game theme won Gold Medal for Best Slot Product QuikTicket™ technology awarded Silver Medal for Best Consumer Service Technology | ||||

| Near-term, we expect the gaming industry will likely be in a recovery mode. But, as we look to the longer-term, we will work for a stronger future. Everi’s performance over the last three years demonstrates our Company’s dramatic improvement that has been accomplished by our team’s collaborative efforts. | ||||||

Working together, our employees have enhanced and expanded our service and product offerings, through both internal development and complementary tuck-in acquisitions. We believe this broader portfolio will continue to drive a significant increase in the amount of patron interaction touchpoints on the casino floor, and thus make our integrated offerings a highly sought-after solution in the gaming industry. This will further strengthen our Company and ultimately lead to strong long-term growth for our customers and our Company. We remain focused on building a team-first culture – a workplace environment where people respect each other’s talents and diverse perspectives, where everyone can find a balance between hard work and fun, and where we all share a passion for teamwork, innovation, and operational excellence. Over time, we believe this will enable Everi to retain and attract talented and dedicated people. | Annual Eilers and Krejcik Gaming Awards Ceremony: Cash Machine™ game theme awarded Top Performing New Mechanical Reel Core Game Shark Week – Jaws of Steel™ game theme awarded Top Performing 3rd Party IP Branded Game | ||||

| The combination of our core values, operating initiatives and long-term growth prospects has provided Everi with a solid foundation on which we can achieve further success. We expect these factors and our focus on fiscal discipline to drive consistent profitable growth and cash flow in the years ahead, as the gaming industry and broader economy recover. We also expect to achieve more commercial progress for our vision to build a transformative digital gaming neighborhood, which will offer compelling value to both our gaming operator customers and their patrons. | |||||

| In closing, we would like to thank each and every one of our team members, as well as our customers, stockholders, and vendor partners, for their ongoing support. Ours is an exciting long-term growth story. We look forward to a future in which we further elevate Everi as a leading supplier of imaginative entertainment and trusted technology solutions for the casino and the interactive gaming industry. | Everi named Most Improved Supplier — Premium | ||||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

To the holders of Common StockDirectors and officers of Everi Holdings Inc.:

The 2016 (“we,” “us,” “Everi” or the “Company”), we are pleased to invite you to attend our 2020 Annual Meeting of Stockholders of Everi Holdings Inc., formerly known as Global Cash Access Holdings, Inc. (the “Company”),Stockholders. The meeting will be held as follows:

When:9:00 a.m., local time, Monday, May 23, 2016

Where:Everi Corporate Headquarters

at Everi’s headquarters located at 7250 S. Tenaya Way, Suite 100,

Las Vegas, Nevada 89113,

The purpose on Tuesday, June 16, 2020 at 9:00 a.m. Pacific Time (the “Annual Meeting”). In recognition of the serious and adverse effect of the COVID-19 pandemic, we will require attendees to comply with health and safety protocols endorsed by the Centers for Disease Control and Prevention, which will include recommended social distancing and personal protective equipment, such as face masks.

1.The election of three Class II directors;

2.The approval, on an advisory basis, of the compensation of our named executive officers as shown in this proxy statement;

3.The ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm;

4.A non-binding stockholder proposal asproposals described in this proxy statement, if properly presented at the Annual Meeting; and

5.To transact such other business as may properly be brought before the Annual Meeting or any adjournment or postponement thereof.

Holders of record of Everi Holdings Inc. common stock at the close of business on April 8, 2016 are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof.

YOUR PROXY IS IMPORTANT TO ASSURE A QUORUM AT THE ANNUAL MEETING. You are urgently requested to submit the enclosed proxy by telephone or through the Internet in accordance with the instructions provided to you. You may also date, sign and mail the Proxy Card in the postage‑paid envelope that is provided. Your proxy is revocable in accordance with the procedures set forthdetail in the accompanying proxy statement.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on May 23, 2016. Our Proxy Statement is attached. Financial and other information concerning Everi Holdings Inc. is contained in our Annual Report to Stockholders for the fiscal year ended December 31, 2015. A complete set of proxy materials relating to our Annual Meeting is available on the Internet. These materials, consisting of the Notice of Annual Meeting of Stockholders, Proxy Statement, Proxy Card and Annual Report to Stockholders are available and may be viewed at www.proxyvote.com.

| |

| |

| |

|

2016 PROXY STATEMENT TABLE OF CONTENTS

This proxy statement is being issued in connection with the solicitation of proxies by the Board of Directors of Everi Holdings Inc. for use at the 20162020 Annual Meeting of Stockholders and Proxy Statement. The Proxy Statement also contains other information that you should read and consider before voting.

our customers and their patrons, and that as our customers reopen their businesses, we too shall begin to recover our lost momentum.

| NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS | ||||||||

Date and |

| |||||||

Time Tuesday, June 16, 2020 9:00 a.m. Pacific Time | ||||||||

|

| |||||||

| Location Everi Holdings Inc. Corporate Headquarters 7250 S. Tenaya Way, Suite 100 Las Vegas, Nevada 89113 In light of the continually evolving public health concerns of the global coronavirus (COVID-19) outbreak, we may hold a Virtual Annual Meeting in lieu of a physical meeting in Las Vegas, Nevada. If we decide to hold a Virtual Annual Meeting, we will announce it in a press release available at http://ir.everi.com/investor-relations/investor-news/default.aspx as soon as practicable prior to the Annual Meeting. | |||||||

| Voting Matters | ||||||||||||||||||||

| ||||||||||||||||||||

| Election of two Class III director nominees named in this Proxy Statement. | ||||||||||||||||||||

Stockholders of record as of April 8, 2016 may cast their votes in any of the following ways:

|

|

|

| ||||||||

|

|

|

| ||||||||

Visit | |||||||||||

| 2. | To approve on a non-binding, advisory basis the compensation of our named executive officers |  | Call 1-800-690-6903 or the number on your | ||||||||

| 3. | To ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. |  | Send your completed and signed proxy card or | ||||||||

| 4. | To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. |  | If you plan to attend the meeting in person, you will need to bring a government-issued picture ID and proof of ownership of Everi Holdings Inc. common stock as of the record date. | ||||||||

Voting Matters and Board Recommendations

|

|

|

|

|

|

|

|

|

|

| Board |

|

|

Item |

| Description |

| Recommendation |

| Page (for more detail) |

1 |

| Election of directors |

| FOR |

| 9 |

2 |

| Approval, on an advisory basis, of named executive officer compensation |

| FOR |

| 23 |

3 |

| Ratification of independent auditor |

| FOR |

| 48 |

4 |

| Stockholder proposal regarding simple majority voting |

| AGAINST |

| 51 |

1

Director Nominees

|

|

| ||

| ||

| Stockholders of record as of the close of business on May 8, 2020 will be entitled to notice of, and to vote at, the Annual Meeting, or any adjournment or postponement thereof. | ||

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on June 16, 2020. Our Proxy Statement is attached. Financial and other information concerning Everi Holdings Inc. is contained in our | ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Director |

|

|

|

|

Name |

| Age |

| Since |

| Principal (or Most Recent) Occupation |

| Current Committees |

Geoff Judge |

| 62 |

| 2006 |

| Partner at iNova Capital, a manager of early stage venture capital funds |

| Audit; Compensation; Nominating and Corporate Governance |

Michael D. Rumbolz |

| 62 |

| 2010 |

| Interim President and Chief Executive Officer of the Company; Former Chairman and Chief Executive Officer of Cash Systems, Inc.; Former Chairman of the Nevada Gaming Control Board |

| None |

Ronald Congemi |

| 69 |

| 2013 |

| Former Chief Executive Officer of First Data’s Debit Services Group; member of the Philadelphia Federal Reserve’s Payments Advisor Council; founder of Star Systems, Inc., an Automated Teller Machine (“ATM”) network |

| Audit; Compensation; Nominating and Corporate Governance |

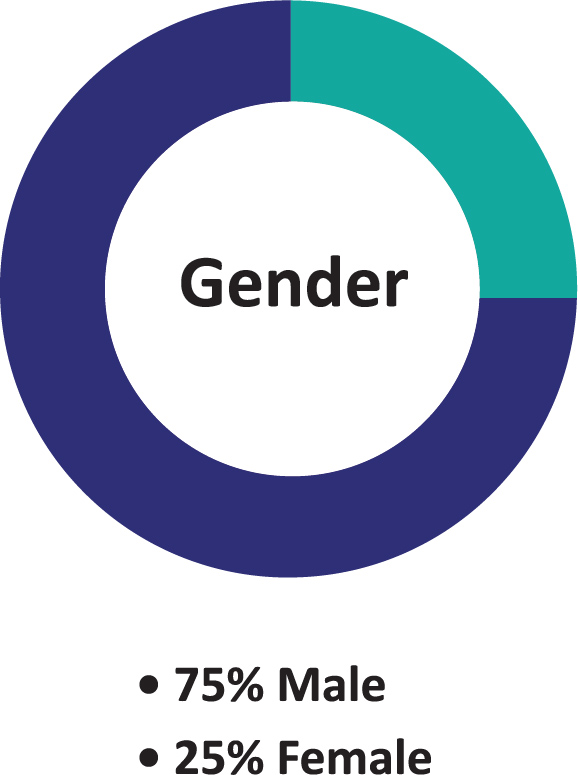

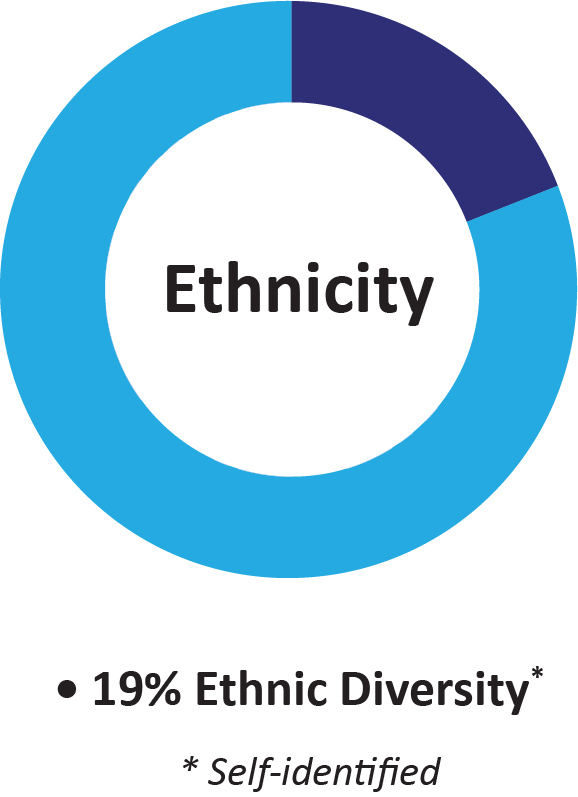

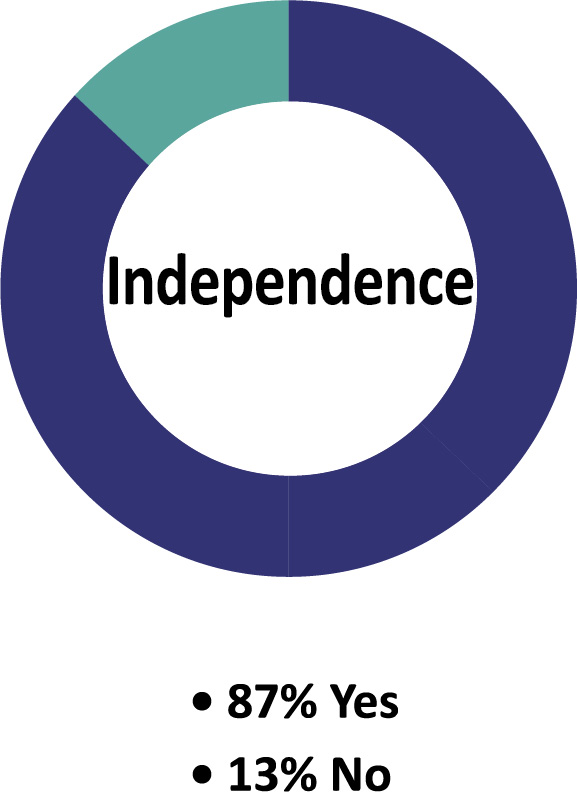

GovernanceThis Notice of Annual Meeting and Compensation Highlights

|

|

|

|

| ||||||

| ||||||

|

| ||||

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

2

Stockholder Engagement

At the 2015 annual meeting of stockholders, our say-on-pay proposal received the support of approximately 51% of the shares voted. Our Board was concerned and disappointed in this outcome, and as a result, we undertook a broad-based stockholder outreach and engagement program to solicit feedback, understand investor concerns and consider any necessary and appropriate actions.

Over several months, our Compensation Committee and management reached out to the majority of top 20 shareholders, representing approximately 68.5% of our shareholders at the time, and had extensive, meaningful dialogue with stockholders representing approximately 42.5% of our outstanding Common Stock, as well as with two leading proxy advisory firms, Institutional Shareholder Services, Inc. and Glass Lewis & Co. Our stockholders were pleased with the proposed changes we were implementing, and asked questions and raised concerns about certain other practices. As a result of these conversations, we made additional changes that will strengthen our compensation program and further align management and stockholder interests. Our stockholders universally expressed a desire for ongoing communication, which we believe is prudent and valuable for all parties.

Although our stockholder base is diverse in type and size, and certainly in processes for compensation program evaluation, several topics were commonly raised, which included:

|

| |||||

|

| |||||

| ||||||

|

| |||||

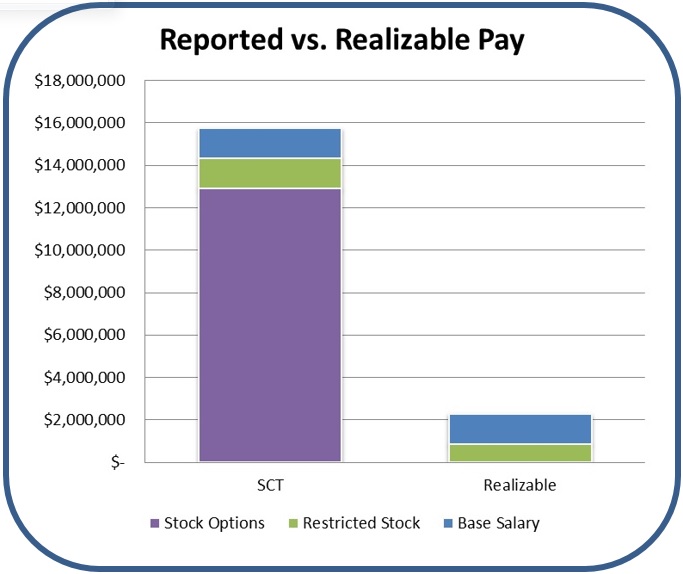

| 2020 Base Salary Decisions | ||||||

3

| PROXY STATEMENT SUMMARY | ||

2016 ANNUAL MEETING PROXY STATEMENT

Why am I receiving these proxy materials?

Theproxies by the Board of Directors (the “Board”) of Everi Holdings Inc., a Delaware corporation, formerly known as Global Cash Access Holdings, Inc. (the (“we,” “us,” “Everi” or the “Company”), is furnishing these proxy materials to you in connection with the Company’s 2016 annual meeting of stockholders (the “Annual Meeting”). The Annual Meeting will be held on Monday, May 23, 2016, for use at the Company’s corporate offices located at 7250 S. Tenaya Way, Suite 100, Las Vegas, Nevada 89113 beginning at 9:00 a.m., local time. You are invited to attend the Annual Meeting and are entitled and requested to vote on the proposals outlined in this proxy statement (this “Proxy Statement”).

This Proxy Statement is dated April 22, 2016 and is first being mailed to stockholders on or about April 25, 2016.

What proposals will be voted on at the Annual Meeting and what are the recommendations of the Board?

There are four proposals scheduled to be voted on at the Annual Meeting. Those proposals, and the Board’s voting recommendations with respect to such proposals, are as follows:

|

| |||

|

|

| ||

|

|

| ||

|

|

| ||

|

|

|

Management does not know of any matters to be presented at the Annual Meeting other than those set forth in this Proxy Statement and in the Notice of2020 Annual Meeting of Stockholders accompanying this Proxy Statement. Without limiting our abilityand at any adjournment or postponement thereof. On or about May 18, 2020, we will begin distributing to apply the advance notice provisions in our Second Amended and Restated Bylaws with respect to the procedures that must be followed for a matter to be properly presented at an annual meeting, if other matters should properly come before the Annual Meeting, the proxy holders will vote on such matters in accordance with their best judgment. Our stockholders have no dissenter’s or appraisal rights in connection with any of the proposals to be presented at the Annual Meeting.

What is the record date and what does it mean?

The record date for the Annual Meeting is April 8, 2016. The record date was established by the Board as required by Delaware law. Only holders of shares of the Company’s common stock, par value $0.001 per share (“Common Stock”), at the close of business on the record date areeach stockholder entitled to receive notice of, and to vote at the 2020 Annual Meeting and any adjournments or postponements thereof. Atof Stockholders this Proxy Statement, the closeNotice of business on April 8, 2016, we had approximately 66,183,745 shares of Common Stock outstanding and entitled to vote.

4

Shares held in treasury by the Company are not treated as being issued or outstanding for purposes of determining the number of shares of Common Stock entitled to vote.

How many votes do I have?

Each holder of shares of Common Stock is entitled to one vote for each share of Common Stock owned as of the record date.

Who is a “stockholder of record” and who is a “beneficial holder”?

You are a stockholder of record if your shares of our Common Stock are registered directly in your own name with our transfer agent as of the record date. You are a beneficial owner if a bank, brokerage firm, trustee or other agent (called a “nominee”) holds your stock. This is often called ownership in “street name” because your name does not appear in the records of the transfer agent. If your shares are held in street name, you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to vote your shares in person at the2020 Annual Meeting you should contact your broker or agent to obtainof Stockholders, a legal proxy or broker’s proxy card or voting instruction form and bring it to theour 2019 Annual Meeting in order to vote.

Who votes shares held in “street name”?

If you are a beneficial owner of shares held in “street name” by a bank, brokerage firm, trustee or other holder of record, and you do not give that record holder specific instructions as to how to vote those shares, then under the rules of the New York Stock Exchange (the “NYSE”), your record holder may exercise discretionary authority to vote your shares on routine proposals, including Proposal 3 (the ratification of the Company’s independent auditors). Without your specific instructions, however, your record holder cannot vote your shares on non‑routine proposals, including the election of directors, the advisory vote on the compensation of our named executive officers and the non-binding stockholder proposal. Accordingly, if you do not instruct your record holder how to vote with respect to Proposal 1 (election of directors), Proposal 2 (advisory vote on executive compensation), and Proposal 4 (stockholder proposal regarding simple majority voting), no votes will be cast on your behalf with respect to such proposals (this is referred to as a “broker non‑vote”). Your record holder, however, will continue to have discretion to vote any uninstructed shares on Proposal 3 (the ratification of the Company’s independent auditors). If you hold your shares in street name, please refer to the information forwarded by your bank, broker or other holder of record for procedures on voting your shares or revoking or changing your proxy. We encourage you to provide instructions to your broker regarding the voting of your shares.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of a majority of the shares of Common Stock outstanding and entitled to vote on the record date will constitute a quorum permitting the proposals described herein to be acted upon at the Annual Meeting. Abstentions and broker non‑votes are counted as present and are, therefore, included for purposes of determining whether a quorum of shares of Common Stock is present at the Annual Meeting.

What is the voting requirement to approve each of the proposals?

|

|

The Company amended its Corporate Governance Guidelines effective July 1, 2015 to include a guideline regarding majority voting for directors. Under the majority voting guideline, if a nominee for director in an uncontested election of directors (i.e., an election other than one in which the number of director nominees exceeds the number of directorships subject to election), does not receive the vote of at least “the majority of the votes cast” at any meeting for the election of directors at which a quorum is present and no successor has been elected at such meeting, the director will promptly tender his or

5

her resignation to the Board. For purposes of this corporate governance guideline, “the majority of votes cast” means that the number of shares voted “for” a director’s election exceeds 50% of the number of votes cast with respect to that director’s election, and “votes cast with respect to that director’s election” includes votes to withhold authority, but excludes abstentions and broker non-votes (i.e., failures to vote with respect to that director’s election). If a nominee for director does not receive the majority of the votes cast in an uncontested election, then that director must promptly tender his or her resignation following certification of the stockholder vote. Thereafter, the Nominating and Corporate Governance Committee is required to make a recommendation to the Board on whether to accept or reject such resignation and whether any other actions should be taken. The Board is required to take action with respect to this recommendation within 90 days following certification of the stockholder vote and to promptly disclose its decision and decision-making process. Full details of the policy are set out in our Corporate Governance Guidelines, which are publicly available at the Corporate Governance section of the Investors page on our website at ir.everi.com/investor-relations/everi-overview.

|

|

|

|

|

|

All valid proxies received prior to the Annual Meeting will be exercised. All sharesReport. Shares represented by a properly executed proxy will be voted, and where a proxy specifies a stockholder’s choice with respect to any matter to be acted upon, the shares will be voted in accordance with that specification. If you are a stockholder of record and sign and return your proxy card or vote electronically without making any specific selections, then your shares will be voted in accordance with the recommendations ofinstructions provided by the proxy holders on all matters presentedstockholder. This summary highlights information contained elsewhere in this Proxy Statement; however, it does not contain all of the information you should consider. You should read the entire Proxy Statement and as the proxy holders may determine in their discretion regardingbefore casting your vote.

| Voting Matters and Board Recommendations | ||||||||||||||||||||||||||||||||||||||

| Proposal | Description | Board Recommendation | Page (for more detail) | |||||||||||||||||||||||||||||||||||

| 1 | Election of two Class III director nominees named in this Proxy Statement. | FOR the Board’s nominees | ||||||||||||||||||||||||||||||||||||

| 2 | Approval, on an advisory basis, of the compensation of our named executive officers. | FOR | ||||||||||||||||||||||||||||||||||||

| 3 | Ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. | FOR | ||||||||||||||||||||||||||||||||||||

How do I vote my shares?

You can either attendmeeting.

|

| |||||||||||||

| Key financial highlights for 2019: | ||||||||||||||

| Games segment record unit sales, record year-end installed base, and 15% improvement in full-year daily win per unit | FinTech segment delivered year-over-year growth in cash access services transactions and revenue, equipment sales, and information and compliance product-related revenue | Reduced principal debt by | ||||||||||||

| Key business highlights for 2019: | ||||||||||||||

| Best Slot Product and Best Consumer-Service Technology Awards from Global Gaming Business | Acquisition of strategic assets from providers of casino loyalty and marketing technology (Atrient and Micro Gaming Technologies) | Delivered exclusive Gaming content to the | ||||||||||||

| Southern California Gaming Guide Reader’s Choice 2019 Best Slots | Extended relationship to continue to provide and manage the New York Lottery’s central monitoring system for another 10 years to 2029 | |||||||||||||

|

|

|

|

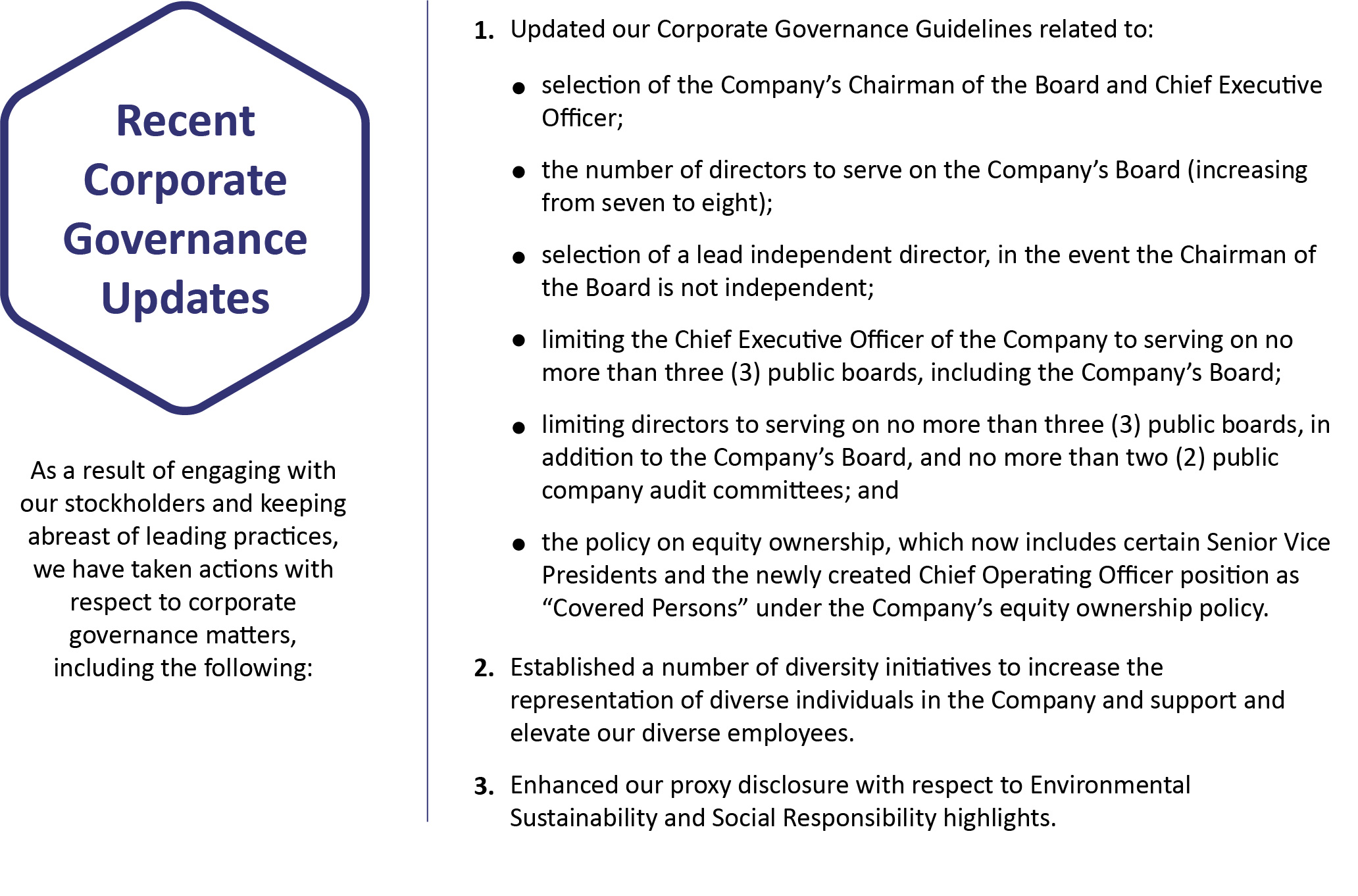

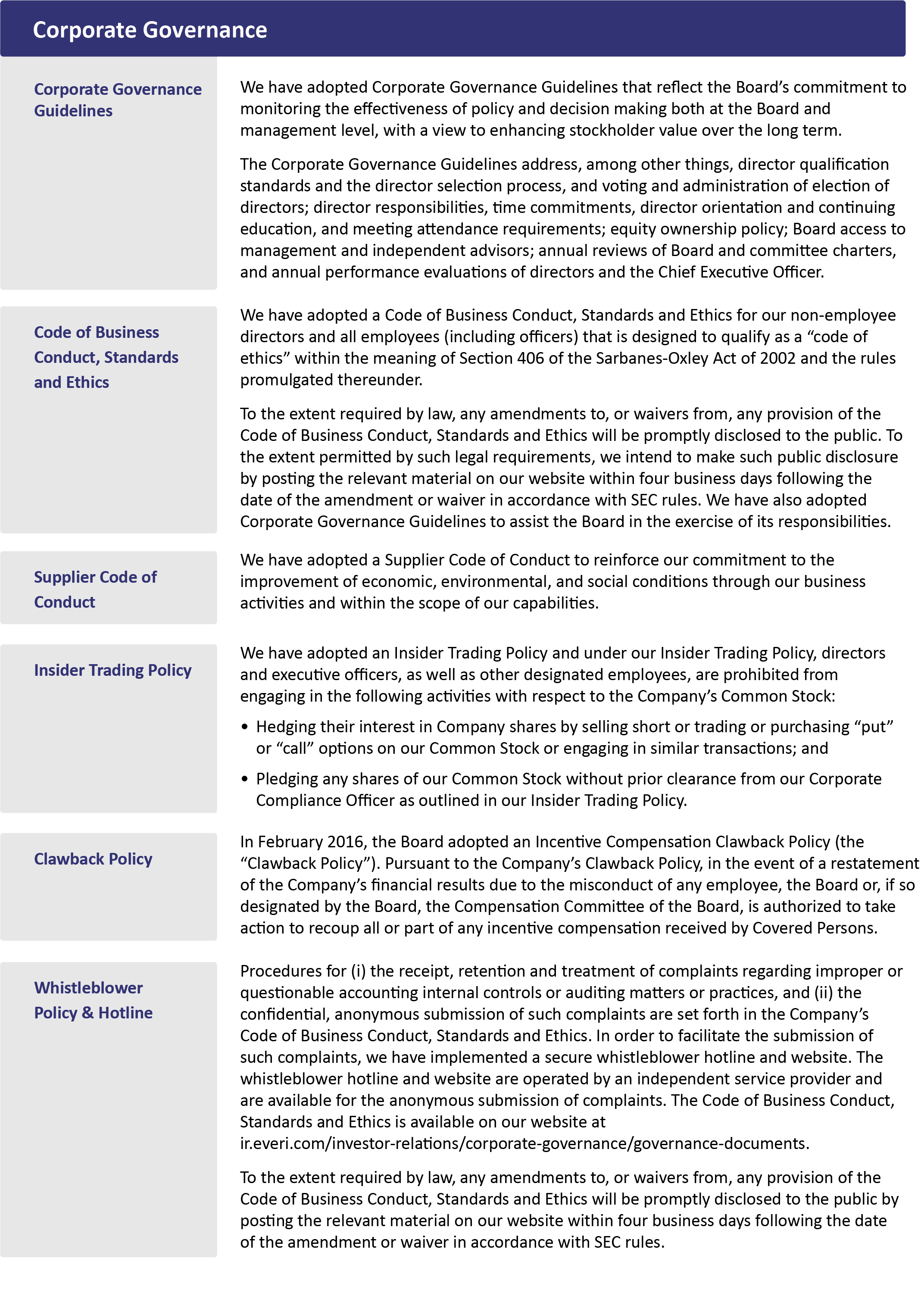

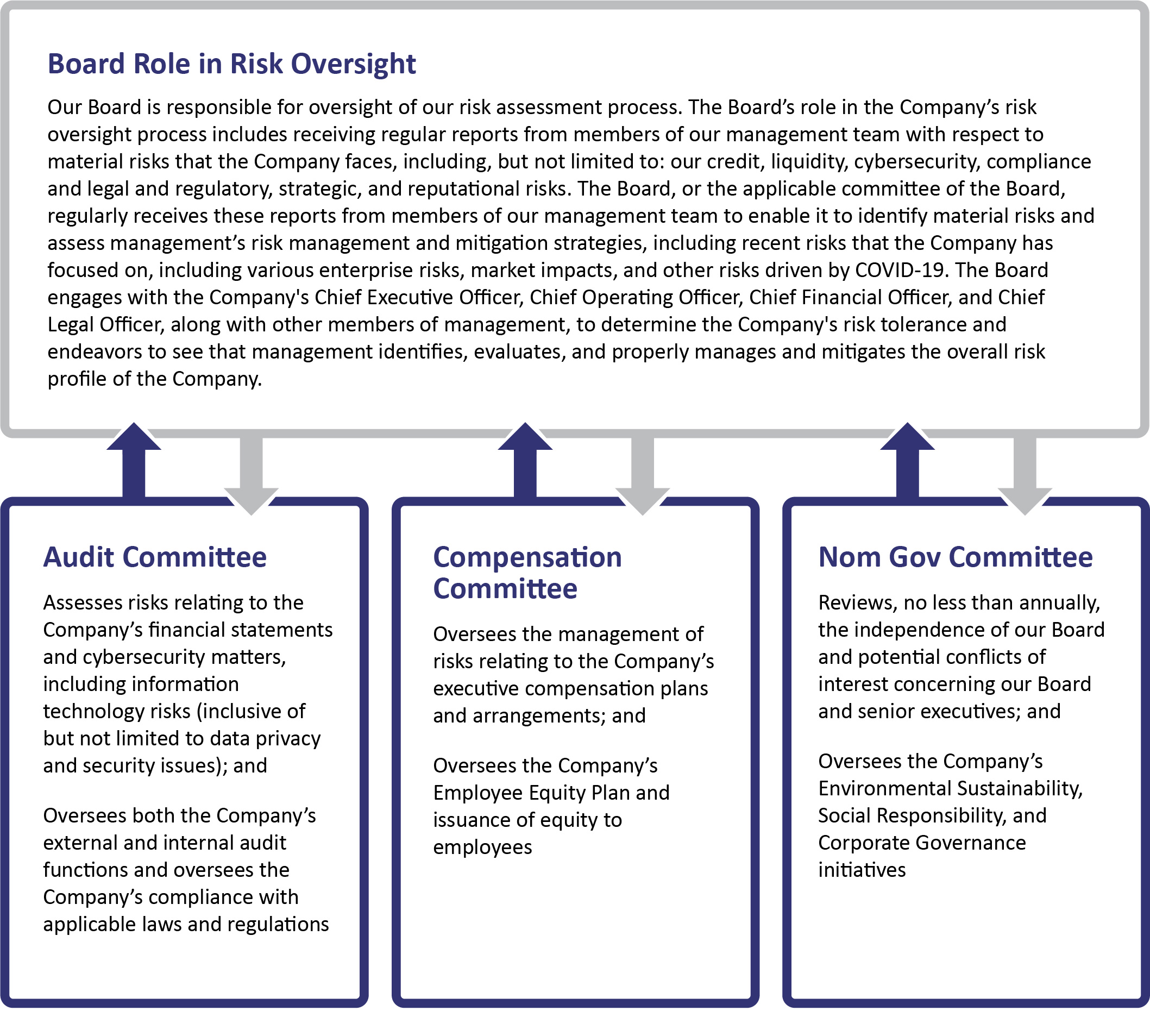

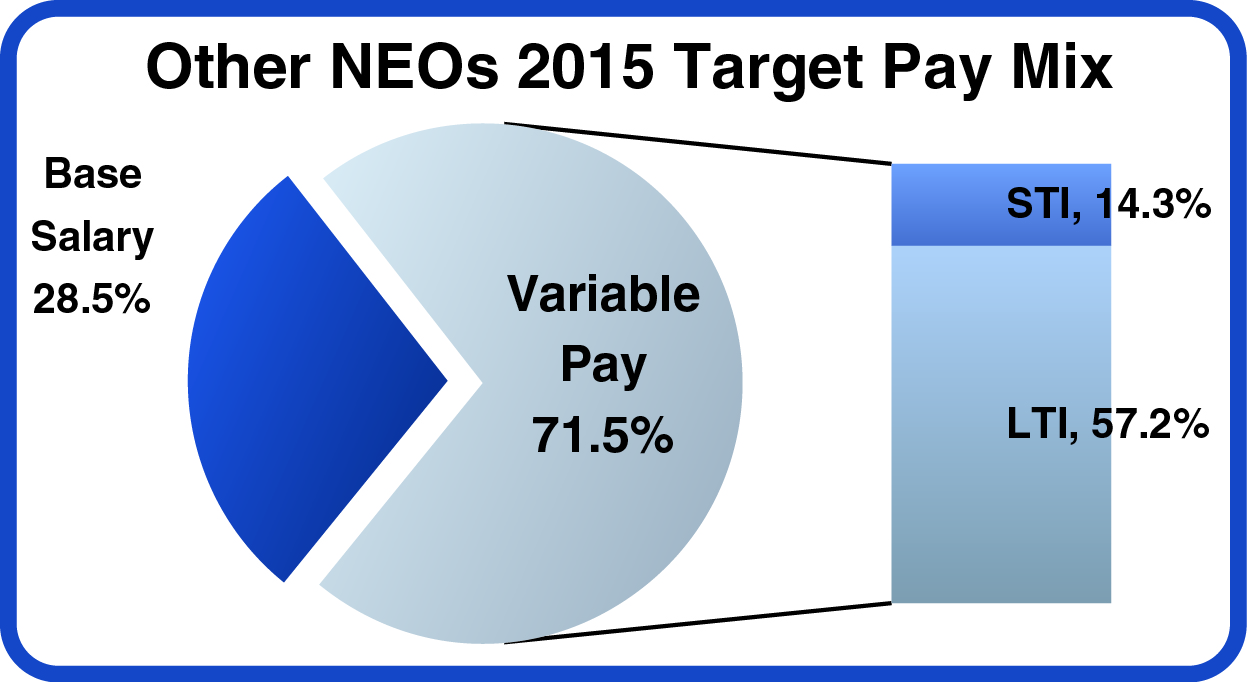

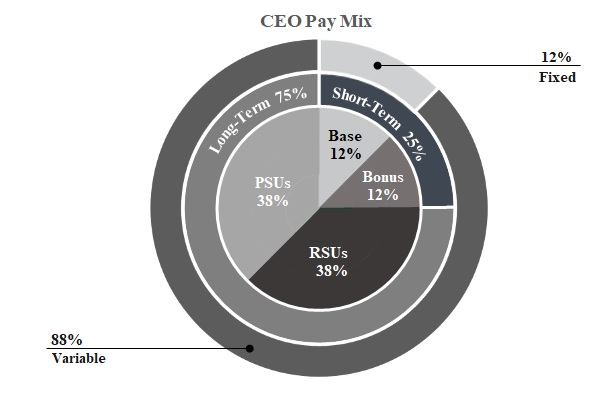

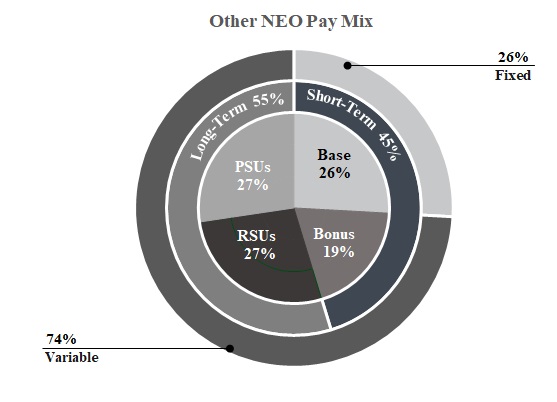

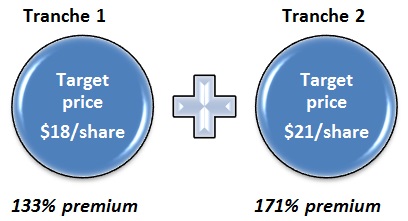

Our Class Directors Term Expiration 2018 Annual Meeting of Stockholders II Ms. Mullarkey was initially recommended to the Nom Gov Committee by Mr. Rumbolz, Director and Chief Executive Officer Each of the Company’s directors listed below will continue in office for the remainder of his or her term and until a successor is duly elected and qualified or until his or her earlier resignation or removal. Information regarding the business experience, skills and qualifications, and directorships of each such director is provided below. Class addition, from time to time, special committees may be established under the direction of the Board when necessary to address specific issues. The composition of the Board E. Miles Kilburn Chair Eileen F. Raney Fees earned or paid in Stock Option Name cash awards(1) awards(1) Total E. Miles Kilburn(2) $ $ — $ $ Geoff Judge(2) — Fred Enlow(2) — Michael D. Rumbolz(2)(3) — Ronald Congemi(2) — Shares underlying Unvested outstanding Name stock awards options E. Miles Kilburn Geoff Judge Fred Enlow Michael D. Rumbolz Ronald Congemi — Compensation Committee Interlocks and Insider Participation Review, Approval or Ratification of Transactions with Related Persons Communication Between Interested Parties and Directors Name Age Position Michael D. Rumbolz Executive Vice President, Chief Legal Officer, General Counsel and Corporate Secretary program for 2019. Our Compensation Committee, which is responsible for designing and administering our executive compensation program, has designed our executive compensation program to provide a competitive and internally equitable compensation and benefits package that reflects officers. resolution: Name Current Title and formerExecutive Vice President and Chief Financial Officer Executive Vice President, Executive Summary Section I Compensation Philosophy and Objectives Section II Compensation Decision Making Process Section III Compensation Competitive Analysis Section IV Elements of Compensation Section V Additional Compensation Practices and Policies Section VI Aligns the interests of management and stockholders $13.43 per share. Role of Management discussed except at the request of the Compensation Committee. In making this determination, the Compensation Committee and Nom Gov Committee each noted that during 2019: 2019. Company Ticker Revenue Market Cap Enterprise Value Type ($mm) ($mm) ($mm) Boyd Gaming Corporation BYD $ $ $ Gaming Outerwall Inc. OUTR $ $ $ Gaming Scientific Games Corp. SGMS $ $ $ Gaming Churchill Downs Inc. CHDN $ $ $ Gaming JAKKS Pacific, Inc. JAKK $ $ $ Gaming Zynga, Inc. ZNGA $ $ $ Gaming Dreamworks Animation SKG Inc. DWA $ $ $ Gaming LeapFrog Enterprises LF $ $ $ Gaming Glu Mobile, Inc. GLUU $ $ $ Gaming Heartland Payments Systems, Inc. HPY $ $ $ Payments VeriFone Systems, Inc. PAY $ $ $ Payments Euronet Worldwide, Inc. EEFT $ $ $ Payments Moneygram International Inc. MGI $ $ $ Payments Blackhawk Network Holdings, Inc. HAWK $ $ $ Payments Cardtronics, Inc. CATM $ $ $ Payments WEX Inc. WEX $ $ $ Payments Green Dot Corporation GDOT $ $ $ Payments Evertec, Inc. EVTC $ $ $ Payments 18 Peers 25th %ile $ $ $ Median $ $ $ 75th %ile $ $ $ Everi Holdings Inc. $ $ $ Rank % % % Salary Compensation 2014 2015 Name Annual Base Actual Paid Annual Base Actual Paid Ram Chary $ $ (1) $ $ Randy L. Taylor (2) Juliet A. Lim (3) David Lucchese Edward A. Peters (4) (1)Effective April 1, 2020, in his position as Special Advisor of the Company, Mr. salaries. Name Target Maximum (As a % of base salary) Mr. Chary(1) % % Mr. Taylor, Ms. Lim & Mr. Lucchese % % Mr. Peters % % 2015 Actual Performance Metric Weight Threshold - 1 Threshold - 2 Target Threshold - 3 Maximum As % of Target Adjusted EBITDA 50% $210M to $214M to $218M to $220M to $224M to 92% Individual Performance Goals 50% n/a n/a n/a n/a n/a n/a In Corporate Strategy Leadership Enhance Customer and Community Relationships Company’s strategic objectives. unit awards that vest over time, we can align executives’ interests with the 2019. requirements after the Covered Person’s achievement date. Other •Shares owned through the Company’s 401(k) plan (if applicable); and five-year phase-in period. Covered Person. Retirement Plans officers consistent with Company contributions to all eligible non-executive employees; however, since the COVID-19 pandemic, we have suspended contributions to all eligible employees until such time as the Company determines to transition, in whole or in part, toward a return to prior Company contribution levels. Name and principal position Year Salary Bonus Stock awards(1) Option awards(2) Non-equity incentive plan compensation(3) All other compensation(4) Total Randy L. Taylor $ $ - $ - $ $ - $ $ Executive Vice President, Chief Financial Officer - - Juliet A. Lim - - - Executive Vice President, Payments, General Counsel and Corporate Secretary - - David Lucchese - - - (5) Executive Vice President, Games - - - Edward A. Peters - - - (6) Executive Vice President, Sales Ram Chary - - - President and Chief Executive Officer (former)* - - Estimated future payouts under non-equity incentive plan awards (1) Name Grant Date Threshold (2) Target Maximum (3) All other stock awards: number of shares of stock or units All other option awards: number of securities underlying options Exercise or base price of option awards Grant date fair value of stock and option awards(4) Randy L. Taylor $ 50,000 $ 200,000 $ 300,000 4/22/2015 - - - - $ $ 4/22/2015 - - - - Juliet A. Lim 50,000 200,000 300,000 4/22/2015 - - - - 4/22/2015 - - - - David Lucchese 53,125 212,500 318,750 4/22/2015 - - - - 4/22/2015 - - - - Edward A. Peters 50,000 200,000 400,000 4/22/2015 - - - - 4/22/2015 - - - - Ram Chary* 200,000 800,000 1,200,000 4/22/2015 - - - - 4/22/2015 - - - - Option awards Stock awards Number of Number of Equity incentive plan awards: Number of Market value of securities underlying unexercised securities underlying unexercised Number of securities underlying Option Option shares or units of stock that shares or units of stock that Name options exercisable options unexercisable unexercised unearned options exercise price expiration date have not vested have not vested Randy L. Taylor - - $ 12/7/2021 - $ - (4) - 3/2/2022 - - (4) - 3/6/2023 - - (1) - 5/2/2024 - - - - (2) 5/2/2024 - - - - (5) 4/22/2022 - - - - - - - (4) - - - - - (1) Juliet A. Lim (1) - 5/2/2024 - - - - (2) 5/2/2024 - - - - (5) 4/22/2022 - - - - - - - (1) David Lucchese - - 4/30/2020 - - - - 3/1/2021 - - (4) - 3/2/2022 - - (4) - 3/6/2023 - - (1) - 5/2/2024 - - - - (2) 5/2/2024 - - - - (5) 4/22/2022 - - - - - - - (4) - - - - - (1) Edward A. Peters (1) - 12/4/2024 - - - - (5) 4/22/2022 - - Ram Chary* (1) - 1/27/2024 - - - - (2) 1/27/2024 - - - - (3) 5/2/2024 - - - - (3) 5/2/2024 - - - - (5) 4/22/2022 - - - - - - - (1) Option Awards Stock Awards Number of shares Number of shares acquired on Value realized acquired on Value realized Name exercise on exercise(1) vesting on vesting(2) Randy L. Taylor - $ - $ David Lucchese - - Juliet A. Lim - - Edward A. Peters - - - - Ram Chary - - Employment Contracts and Equity Agreements, Termination of Employment and Change in Control Arrangements Ehrlich’s employment agreement will renew for one-year periods on January 1st of each year, unless either party provides six months’ notice of nonrenewal. Termination without Cause or For Good Reason Change in Control Termination without Cause following Change in Control Name Cash Payment(1) Benefits(2) Acceleration of Stock and Options(3) Total Acceleration of Stock and Options(3) Cash Payment(1) Benefits(2) Acceleration of Stock and Options(3) Total Randy L. Taylor $ $ $ — $ $ $ $ $ $ Juliet A. Lim — David Lucchese — Edward A. Peters — — — Ram Chary* — Shares Beneficially Owned Name Number Percentage(1) Principal stockholders Mast Capital Management, LLC(2) % Eagle Asset Management, Inc.(3) % FMR, LLC(4) % BlackRock, Inc.(5) % Directors and named executive officers(6) Ram Chary † (7) % E. Miles Kilburn(8) * Geoff Judge(9) * David Lucchese(10) * Fred Enlow(11) * Michael D. Rumbolz(12) * Randy L. Taylor(13) * Ronald Congemi(14) * Juliet A. Lim(15) * Edward A. Peters(16) * Eileen Raney (17) * Directors and current named executive officers as a group (10 persons) (18) % The following table provides information as of December 31, Weighted average Number of securities exercise price of Number of securities to be issued upon outstanding remaining active for exercise of outstanding options, future issuance under equity Plan category options, warrants and rights warrants and rights compensation plans Equity compensation plans approved by stockholders(1) $ (2) Equity compensation plans not approved by stockholders(3) (4) $ (5) Total 2020. 2020. The following table represents fees invoiced for professional audit services rendered by BDO USA, LLP, our independent registered public accounting firm for the The following table presents, for the years ended December 31, 2015 and 2014, fees invoiced for professional audit services rendered by BDO USA LLP, oaaaur current independent registered public accounting firm, and Deloitte & Touche LLP, our prior independent registered public accounting firm, for the audit of the Company’s annual financial statements and fees invoiced for other services rendered by BDO USA LLP and by Deloitte & Touche LLP (amounts in thousands): Year Ended December 31, 2015 2014 Audit fees (1) $ $ Audit-related fees (2) Tax fees (3) - All other fees(4) - Total $ $ corporate-governance/governance-documents Members of the Audit Committee: elect such nominee or nominees. their judgment on such matters. By Order of the Board of Directors, Year Ended December 31, 2019 Reconciliation of Net Income to EBITDA and Interest expense, net of interest income Non-cash stock compensation expense Accretion of contract rights We present The InternetThis Proxy Statement contains “forward-looking statements” as defined in the U.S. Private Securities Litigation Reform Act of 1995, as amended. In this context, forward-looking statements often address our expected future business and telephone voting procedures have been set up for your conveniencefinancial performance, and contain words such as “goal,” “target,” “future,” “estimate,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “hope,” “seek,” “project,” “may,” “should,” “designed to,” “in an effort to,” “will provide,” “look forward to,” or “will” and similar expressions to identify forward-looking statements. Forward-looking statements are not historical fact and are designednot guarantees or assurances of future performance, timing or accuracy. Instead, they speak only as of the date hereof and are based solely on management’s current beliefs, expectations, estimates and assumptions, based on currently available information, regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions.Because forward-looking statements relate to authenticate stockholders’ identities,the future, they are subject to allow stockholdersinherent risks, uncertainties and changes in circumstances that are often difficult to provide their voting instructions,predict and many of which are beyond our control. Our actual results and financial condition may differ materially from those indicated in forward-looking statements for a variety of important factors that include, without limitation, the impact of the ongoing COVID-19 global pandemic on our business, operations and financial condition, our ability to confirmgenerate profits in the future; our substantial leverage and the related covenants that their instructions have been recorded properly. The Company believesrestrict our operations; our ability to generate sufficient cash to service all of our indebtedness, fund working capital, and capital expenditures; our ability to withstand unanticipated impacts of a pandemic outbreak of uncertain duration; our ability to withstand the procedures that have been putloss of revenue during the closure of our customers’ facilities; our ability to maintain our current customers; our ability to compete in place arethe gaming industry; our ability to execute on mergers, acquisitions and/or strategic alliances, including the timing and closing of acquisitions, and our ability to integrate and operate such acquisitions consistent with our forecasts; inaccuracies in underlying operating assumptions; expectations regarding customers’ preferences and demands for future gaming offerings; expectations regarding our product portfolio; the requirementsoverall growth of applicable law.the gaming industry, if any; our ability to replace revenue associated with terminated contracts; our ability to introduce new products and services, including third-party licensed content; gaming establishment and patron preferences; our ability to prevent, mitigate or timely recover from cybersecurity breaches, attacks and compromises; the level of our capital expenditures and product development; anticipated sales performance; employee turnover; national and international economic conditions; changes in global market, business and regulatory conditions arising as a result of the COVID-19 global pandemic; unanticipated expenses or capital needs and those other risks and uncertainties discussed in our most recent Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 2, 2020, our Form 8-K filed on April 21, 2020, and 6Specific instructions for stockholders who wish to usewith the Internet or telephone voting procedures are set forth oninformation included in our other press releases, reports, and other filings with the enclosed proxy card. If your shares are heldSEC. Understanding the information contained in street name by a bank, brokerage firm, trustee or other holder of record, you will receive instructions from the record holder that you must followthese filings is important in order to have your shares voted.Who will tabulatefully understand our reported financial results and our business outlook for future periods. Given these risks and uncertainties, readers are cautioned not to place undue reliance on the votes?An automated system administered by Broadridge Financial Solutions, Inc. (“Broadridge”) will tabulate votes cast by proxyforward-looking statements contained herein.On March 13, 18, and 24, and April 21 and 27, 2020, the Company also issued Current Reports on Form 8-K to address certain aspects of the ongoing COVID-19 pandemic on the Company, including descriptions of actions that the Company is taking to address this impact, including certain cost reduction initiatives and providing certain business updates related to its liquidity and operations as a result of the ongoing COVID-19 pandemic, and that the Company is withdrawing its annual 2020 financial guidance provided on March 2, 2020 due to the impact of the ongoing COVID-19 pandemic. Accordingly, investors should no longer rely on that information. The Company is not providing an updated outlook at the Annual Meetingthis time and a representative of Broadridge will tabulate votes cast in person at the Annual Meeting.Is my vote confidential?Proxy instructions, ballotshas suspended all share repurchases under its previously authorized repurchase program.2Corporate Governance Highlights 3

3 Policies Related to Equity OwnershipEquity ownership. The Company and

Policies Related to Equity OwnershipEquity ownership. The Company and voting tabulations that identify individualits stockholders are handledbest served by a board and executive team that manage the business with a long-term perspective. As such, the Company adopted the Equity Ownership Policy in February 2016, and amended the policy as set forth in the Company’s Corporate Governance Guidelines in October 2019 and again in February 2020, as the Company believes stock ownership is an important tool to strengthen the alignment of interests among stockholders, directors, named executive officers, and other executives (each, a manner“Covered Person,” and collectively, “Covered Persons”). The amended policy provides that protects your voting privacy. Your vote will notthe applicable required level of equity ownership is expected to be disclosedsatisfied by our Covered Persons within five years of the later of: (i) February 25, 2016; and (ii) the date such Covered Person first becomes subject to the Equity Ownership Policy. At December 31, 2019, all current named executive officers, other officers, and non-employee directors either met the ownership guidelines or were within the Company or to third parties, except as necessary to meet applicable legal requirements or to allow forfive-year phase-in period. For more information on the tabulation and/or certificationEquity Ownership Policy, see “EXECUTIVE COMPENSATION — Compensation Discussion and Analysis — Additional Compensation Policies and Practices — Equity Ownership Policy.”Clawback. The Board of the vote.Can I change my vote after submitting my proxy?You can change your vote at any time before your proxy is exercised atCompany adopted an Incentive Compensation Clawback Policy in February 2016 which entitles the Annual Meeting. You may do soCompany to recover certain compensation previously paid to its Covered Persons. The policy provides that, in onethe event of the following four ways:·submitting another proxy card bearing a later date;·sending a written notice revoking your proxy to the Corporate Secretary of the Company at 7250 South Tenaya Way, Suite 100, Las Vegas, Nevada 89113;·submitting new voting instructions via telephone or the Internet (if initially able to vote in that manner); or·attending the Annual Meeting and voting in person.If you hold your shares in “street name” through a bank, broker, trustee or other holder of record and you have instructed the bank, brokerage firm, trustee or other holder of record to vote your shares, you must follow the directions received from the holder of record to change those instructions. Please refer to the information forwarded by your bank, brokerage firm, trustee or other holder of record for procedures on revoking or changing your proxy.Who is paying for this proxy solicitation?This proxy solicitation is being made by the Company. The Company will bear the cost of soliciting proxies, including the cost of preparing, assembling, printing and mailing this Proxy Statement. The Company also will reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. In addition, proxies may be solicited by certainrestatement of the Company’s directors, officers and regular employees, either personally,financial statements for any fiscal year commencing after December 31, 2015 that is due to the misconduct of any employee, the Board or, if so designated by telephone, facsimile or e‑mail. None of such persons will receive any additional compensation for their services.How can I find out the voting results?The Company will reportBoard, the voting results in a Current Report on Form 8‑K to be filed within four business days after the endCompensation Committee of the Annual Meeting.How do I receive electronic accessBoard, is authorized to proxy materials for future annual meetings?Stockholders can electtake action to view future proxy statements and annual reports overrecoup all or part of any incentive compensation received by a Covered Person. The Clawback Policy was amended concurrent with the Internet insteadamendment of receiving paper copies, which results in cost savings forour Equity Ownership Policy to include certain Senior Vice Presidents. As of the Company. If you are a stockholder of record and would like to receive future proxy materials electronically, you can elect this option by following the instructions provided when you vote your proxy over the Internet at www.proxyvote.com. If you choose to view future proxy statements and annual reports over the Internet, you will receive an e‑mail notification next year with instructions containing the Internet address of those materials. Your choice to view future proxy statements and annual reports over the Internet will remain in effect until you contact either your broker or the Company to rescind your instructions. You do not have to elect Internet access each year.7If your shares of Common Stock are registered in the name of a brokerage firm, you still may be eligible to vote your shares of Common Stock electronically over the Internet. A large number of brokerage firms are participating in the Broadridge online program, which provides eligible stockholders who receive a paper copydate of this Proxy Statement, no shares of Company Common Stock were pledged by any director or executive officer. For more information on the opportunity to vote via the Internet. If your brokerage firm is participating in Broadridge’s program, your proxy card will provide instructions for voting online. If your proxy card doesClawback Policy, see “EXECUTIVE COMPENSATION — Compensation Discussion and Analysis — Additional Compensation Policies and Practices— Clawback Policy” and our website at ir.everi.com/investor-relations/corporate-governance/governance-documents.No hedging. We do not reference Internet information, please complete and return your proxy card.How can I avoid having duplicate copies of the proxy statements sent to my household?The Securities and Exchange Commission (“SEC”) has adopted rules that permit companies and intermediaries, such as brokers, to satisfy delivery requirements for annual reports and proxy statements with respect to twobelieve our executive officers or more stockholders sharing the same address by delivering a single annual reportdirectors should speculate or proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. Brokers with account holders who are stockholders of the Company may be householding the Company’s proxy materials. Once you have received notice from your broker that it will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate annual report or proxy statement or if you are receiving multiple copies thereof and wish to receive only one, please notify your broker or notify the Company by sending a written request to the Company’s Investor Relations department at 7250 South Tenaya Way, Suite 100, Las Vegas, Nevada 89113, telephone number (702) 855‑3000.When are stockholder proposals due for next year’s annual meeting?Stockholder proposals may be includedhedge their interests in our proxy materials for an annual meeting so long as theyCommon Stock. Our Insider Trading Policy therefore prohibits them from making short sales of our Common Stock or from purchasing or selling puts, calls or other derivative securities involving our stock.No pledging. Our Insider Trading Policy prohibits our executive officers and directors from pledging our Common Stock.4 5

5PROXY STATEMENT PROPOSAL 1ELECTION OF TWO CLASS III DIRECTORS(Item No. 1 on the Proxy Card)THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION TO THE BOARD OF THE NOMINEES NAMED BELOW.Qualifications of Our Class III Director Nominees: þ Mr. Fox and Ms. Mullarkey are provided to us on a timely basisindependent.þ Mr. Fox and satisfy certain other conditions established by the SEC, including specifically under Rule 14a‑8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To be timely, a proposalMs. Mullarkey have been determined to be included infinancial experts.þ Mr. Fox and Ms. Mullarkey, respectively, have 4+ and 2+ years of service on our proxy statement must be received at our principal executive offices, addressed to our SecretaryBoard.þ The two nominees are highly-qualified individuals with a diverse set of the Company, not less than 120 calendar days before the date of our proxy statement released to stockholders in connection with the previous year’s annual meeting. Accordingly, for a stockholder proposal to be included in our proxy materials for our 2017 annual meeting of stockholders, the proposal must be received at our principal executive offices, addressed to our Secretary of the Company, not later than the close of business on December 26, 2016.Subject to certain exceptions, stockholder business that is not intended for inclusion in our proxy materials may be brought before an annual meeting so long as notice of the proposal as specified by,skills, background, and subject to the conditions set forth in, our Second Amended and Restated Bylaws, is received at our principal executive officers, addressed to our Secretary of the Company, not earlier than the close of business on the 120th day, nor later than the close of business on the 90th day, prior to the first anniversary of the date of the preceding year’s annual meeting. For our 2017 annual meeting of stockholders, proper notice of business that is not intended for inclusion in our proxy statement must be received no earlier than the close of business on January 23, 2017, nor later than the close of business on February 22, 2017.A stockholder’s notice to the Secretary must set forth as to each matter the stockholder proposes to bring before the annual meeting: (i) as to each person whom the stockholder proposes to nominate for election or reelection as a director all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to Regulation 14A under the Exchange Act and Rule 14a‑4(d) thereunder (including such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected); (ii) as to any other business that the stockholder proposes to bring before the meeting, a brief description of the business desired to be brought before the meeting, the reasons for conducting such business at the meeting and any material interest in such business of such stockholder and the beneficial owner, if any, on whose behalf the proposal is made; and (iii) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made (a) the name and address of such stockholder, as they appear on the Company’s books, and of such beneficial owner, (b) the class and number of shares of the Company which are owned beneficially and of record by such stockholder and such beneficial owner, and (c) whether either such stockholder or beneficial owner intends to deliver a proxy statement and form of proxy to holders of, in the case of the proposal, at least the percentage of the Company’s voting shares required under applicable law to carry the proposal or, in the case of a nomination or nominations, a sufficient number of holders of the Company’s voting shares to elect such nominee or nominees.8Name Age Director Since Principal (or Most Recent) Occupation Current Committees Linster W. Fox 71 2016 Former Executive Vice President, Chief Financial Officer and Secretary of SHFL entertainment, Inc., a global gaming supplier •Audit Committee (Chair)•Compensation Committee•Nominating and Corporate Governance (“Nom Gov”) CommitteeMaureen T. Mullarkey 60 2018 Former Executive Vice President and Chief Financial Officer of International Game Technology (currently known as International Game Technology PLC), a leading supplier of gaming equipment and technology •Audit Committee•Compensation Committee•Nom Gov CommitteeELECTION OF CLASS II DIRECTORS Amended and Restated Certificate of Incorporation as amended, provides that the number of directors that shall constitute the Board shall be exclusively fixed by resolutions adopted by a majority of the authorized number of directors constituting the Board. The Company’s Second Amended and Restated Bylaws state that the authorized number of directors of the Company shall be fixed in accordance with the Company’s certificate of incorporation as then in effect.incorporation. The authorized number of directors of the Company is currently set at seven, and there is one position on the Board that is currently vacant. The Company’s Amended and Restatedeight. Our Certificate of Incorporation as amended, and Second Amended and Restated Bylaws provide that the Board shall be divided into three classes constituting the entire Board. The members of each class of directors serve staggered three‑yearthree-year terms. Proxies cannot be voted for a greater number of persons than the number of nominees named in this Proxy Statement. Currently,As of the filing of the Proxy Statement, the Board is composed of the following sixeight members:6Term Commencement ILinster W. Fox and Maureen T. Mullarkey(1)2017 Annual Meeting of Stockholders 2020 Annual Meeting of Stockholders I E. Miles Kilburn, and Eileen F. Raney, and Atul Bali(2)2021 Annual Meeting of Stockholders GeoffGeoffrey P. Judge, Michael D. Rumbolz, and Ronald V. Congemi20162019 Annual Meeting of StockholdersIIIFred C. Enlow20172022 Annual Meeting of Stockholders___________________(1)Ms. Mullarkey’s term of office began on March 7, 2018, when she was appointed to the Board.(2)Mr. Bali’s term of office began on November 4, 2019, when he was appointed to the Board.Upon the recommendation of the Nominating and Corporate GovernanceNom Gov Committee of the Board, the Board has nominated Messrs. Judge, RumbolzLinster W. Fox and Congemi, who are each currently aMaureen T. Mullarkey, current Class II DirectorIII Directors of the Company, for reelection as a Class II DirectorIII Directors of the Company, toCompany. If reelected, each will serve a three‑yearthree-year term until the 2019 annual meeting2023 Annual Meeting of stockholdersStockholders and until a respectivehis or her successor is each duly elected and qualified or until his or her earlier resignation or removal. Each of Messrs. Judge, RumbolzMr. Fox and CongemiMs. Mullarkey have consented, if reelected as a Class II DirectorIII Directors of the Company, to serve until his term expires.their respective terms expire. The Board believes that each of Messrs. Judge, RumbolzMr. Fox and CongemiMs. Mullarkey will serve if elected, but if one of thema nominee should become unavailable to serve as a director, and if the Board designates a substitute nominee, the person or persons named as proxy in the enclosed form of proxy may vote for a substitute nominee recommended by the Nominating and Corporate GovernanceNom Gov Committee and approved by the Board.Information Concerning the Director NomineesInformation regarding the business experience of our nominees for election as a Class II DirectorIII Directors is provided below.below, as well as a description of the skills and qualifications that are desirable in light of our business and structure, and led to the conclusion that each nominee should serve as a director.762The Board believes Mr. Judge is qualified to serve as a member of our Board due to his knowledge of the Company’s business and his experience in the financial services and payments industries.Mr. Judge serves as a director of numerous privately held companies.Geoff JudgeAge 62Geoff JudgeLinster W. FoxINDEPENDENT, AUDIT COMMITTEE FINANCIAL EXPERTAge: has71Director Since: 2016Committees: Audit (Chair), Compensation, Nom GovBACKGROUND •Retired and previously served as a memberExecutive Vice President, Chief Financial Officer and Secretary of the Board since September 2006. Since 2010, Mr. Judge has been a Partner at iNovia Capital, a manager of early stage venture capital funds. Prior to joining iNovia, he was an early stage private investor. From 2003 to 2005, he was an investor in and the Chief Operating Officer of Preclick, a digital photography software firm. In 2002, he was the Chief Operating Officer of Media Solution Services,SHFL entertainment, Inc., a providerglobal gaming supplier, from 2009 up until the company’s acquisition by Bally Technologies, Inc. in November 2013•Served on the Executive Advisory Board of credit card billing insert media. From 1997the Lee Business School at the University of Nevada-Las Vegas from 2015 to 2002, Mr. Judge was2016•Served as interim Chief Financial Officer of Vincotech in 2009 and as Executive Vice President, Chief Financial Officer and Secretary of Cherokee International Corp. from 2005 to 2009•Served in a co‑founder and Seniorvariety of executive roles over the course of 18 years at Anacomp, Inc., including Executive Vice President and General Manager of the media division of 24/7 Real Media. From 1995 to 1997, he was a Vice President of Marketing for iMarket, Inc., a software company. From 1985 to 1994, Mr. Judge was a Vice President and General Manager in the credit card division of American Express.Skills and Qualifications:The Board believes Mr. Judge is qualified to serve as a member of our Board due to his knowledge of the Company’s business and his experience in the financial services and payments industries.Other Directorships: Mr. Judge serves as a director of numerous privately held companies.9Michael D. RumbolzAge 62Michael D. Rumbolz has served as our Interim President and Chief ExecutiveFinancial Officer since February 13, 2016 and as a member of the company’s Board since August 2010. From August 2008 to August 2010, of Directors•Began his career as an accountant at PricewaterhouseCoopers LLC•Mr. Rumbolz served as a consultant to the Company advising the Company upon various strategic, product development and customer relations matters. Mr. Rumbolz served as the Chairman and Chief Executive Officer of Cash Systems, Inc., a provider of cash access services to the gaming industry, from January 2005 until August 2008 when the Company acquired Cash Systems, Inc. Mr. Rumbolz also has provided various consulting services and held various public and private sector employment positions in the gaming industry, including serving as Member and Chairman of the Nevada Gaming Control Board from January 1985 to December 1988. Mr. RumbolzFox is a Director of Seminole Hard Rock Entertainment, LLC. Mr. Rumbolz is also the former Vice Chairman of the Board of Casino Data Systems, was the President and Chief Executive Officer of Anchor Gaming, was the Director of Development for Circus Circus Enterprises (later Mandalay Bay Group) and was the President of Casino Windsor at the time of its openingCertified Public Accountant in Windsor, Ontario. In addition, Mr. Rumbolz is the former Chief Deputy Attorney General of the State of Nevada. California. His license is presently inactive.Skills•Has a B.S.B.A. from Georgetown University in Washington, D.CDIRECTOR QUALIFICATIONS Mr. Fox provides valuable knowledge and Qualifications:The Board believes Mr. Rumbolz is qualifiedskills to serve as a member of our Board due to his financial background and experience in the cash accessgaming industry. Mr. Fox is a certified public accountant, with an inactive license in the State of California, and gaming industries.Other Directorships: Mr. Rumbolz currently serveshas been designated as a member of the Board of Directors of Employers Holdings, Inc. (NYSE: EIG).Maureen T. MullarkeyINDEPENDENT, AUDIT COMMITTEE FINANCIAL EXPERTAge: 60Director Since: 2018Committees: Audit, Compensation, Nom GovRonald CongemiAge 69Ronald Congemi• has servedRetired in 2007 as a member of the Board since February 2013. Mr. Congemi currently serves as a member of the Philadelphia Federal Reserve’s Payments Advisor Council. Mr. Congemi previously served as the Chief Executive Officer of First Data’s Debit Services Group from 2004 until his retirement at the end of 2008. Mr. Congemi also served as Senior Vice President of Concord EFS, Inc., a payment and network services company (which was acquired by First Data Corporation in February 2004), and Concord’s Network Services Group. Mr. Congemi founded Star Systems, Inc., an ATM and Personal Identification Number, or PIN, debit network in the United States, and served as its President and Chief ExecutiveFinancial Officer of International Game Technology (currently known as International Game Technology PLC), a leading supplier of gaming equipment and technology, a position Ms. Mullarkey held from 19841998 to 2008.Skills2007, and Qualifications: served in a variety of financial and executive management positions in her 18 years with the company•The Board believes Mr. Congemi is qualified to serveServed since 2014 as a memberdirector of PNM Resources, Inc. (NYSE: PNM), a holding company with two regulated utilities providing electricity and electric services in the State of New Mexico and Texas•Served as a director of NV Energy, Inc. from 2008 to 2013 when the company was sold to Mid-American Energy Holdings Company, a subsidiary of Berkshire Hathaway, Inc.•Served as Entrepreneur in Residence with The Nevada Institute of Renewable Energy Commercialization from 2009 to 2011•Has a B.S. from the University of Texas and an M.B.A. from the University of Nevada-RenoDIRECTOR QUALIFICATIONS Ms. Mullarkey provides valuable knowledge and skills to our Board due to his managementher financial skills and experience in the paymentsgaming industry.Other Directorships: None.THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION TO THE BOARD OF THE NOMINEES NAMED ABOVE.810

Directors Whose Terms Will Expire in Future YearsDirectors Not Up for ElectionIII DirectorI Directors Whose Term Will Expire in 2017E. Miles KilburnINDEPENDENT, AUDIT COMMITTEE FINANCIAL EXPERTAge: 57Director Since: 2005Committees: Audit, Compensation, Nom GovFred C. EnlowAge 76Fred C. Enlow• has servedServes as a member of the Board since October 2006. Since 2000, Mr. Enlow has been a consultant to various financial institutions, primarily involving international consumer financial business. Previously, he was a director, Chairman of the Board and Chairman of the Audit Committee of Prudential Vietnam Finance Company a group executive director of Standard Chartered Bank PLC, a Vice Chairman and director of MBNA America Bank, Chairman of MasterCard International’s Asia Pacific region and member of the Board of Directors and Executive Committee of MasterCard International.Skills and Qualifications:The Board believes Mr. Enlow is qualified to serve as a member of our Board due to his experience in the financial services and payments industries. Other Directorships: None.Class I Directors Whose Terms Will Expire in 2018E. Miles KilburnAge 53E. Miles Kilburn• has served as a member of the Board since March 2005Co-founder and currently serves as Chairman of the Board. Mr. Kilburn is the co‑founder and a partner of Mosaik Partners, LLC, a venture capital firm focused on commerce enabling technology. He has been afinancial technology he founded in 2012•A private investor focused on the electronic payments sector since June 2004. Prior to that, Mr. Kilburn was 2004•Executive Vice President and Chief Strategy Officer of Concord EFS, Inc., a payment and network services company (which was acquired by First Data Corporation in February 2004), from 2003 to 2004, and Senior Vice President of Business Strategy and Corporate Development from 2001 to 2003. He served2003•Served as Chief Executive Officer of Primary Payment Systems, Inc. (now Early Warning)Warning Services, LLC), a subsidiary of Concord EFS, Inc., from 2002 to 2003, and Chief Financial Officer from 1997 to 1999. From 1995 to 2001, Mr. Kilburn served in various roles at Star Systems, Inc., ultimately1999•Served as Group Executive Vice President and Chief Financial Officer.SkillsOfficer at Star Systems, Inc. and Qualifications: various other executive roles from 1995 to 2001The Board believes DIRECTOR QUALIFICATIONS Mr. Kilburn is qualifiedprovides valuable knowledge and skills to serve as a member on our Board due to his skills and experience in management, operating, and investment experienceinvesting in the financial technology and payments industry, as well as his statusindustries. Mr. Kilburn has been designated as an “audit committee financial expert.”Other Directorships: Mr. Kilburn serves as a director of numerous privately held companies.9Eileen F. RaneyAge 53Eileen F. RaneyINDEPENDENT, AUDIT COMMITTEE FINANCIAL EXPERTAge: has served as a member of the Board since February 2016. Ms. Raney has also served as Vice Chair of the Board of Governors and Chair of the 71Director Since: 2016Committees: Audit, and Finance Committee of the University Medical Center of Southern Nevada since 2014. She has been a member of the Advisory Board for the UNLV Libraries since 2010 and served as a member of the Board of Directors and the Board's Finance Committee at the Nevada Health Centers, a federally qualified health center in Nevada,Compensation, Nom Gov (Chair)BACKGROUND •Served from 2013 to 2015. From January 2011 to November 2013 Ms. Raney served as a member of the Board and a member of the Audit, Compensation and Governance Committees of the Board of SHFL entertainment, Inc., a global gaming supplier that was acquired by Bally Technologies, Inc. in November 2013. From 1988 to 2007, Ms. Raney held numerous positions with Deloitte & Touche USA, LLP, where she was hired2013•Certified as a DirectorNational Association of Corporate Directors (NACD) Board Leadership Fellow in 19882018 and made Principal2019•Active member of the Advisory Board for the University of Nevada-Las Vegas Libraries since 2010•Active member of the Advisory Board of Fino Consulting since June 2015•Served on the Board of the University Medical Center of Southern Nevada from 2014 to 2017, as Vice Chair of the Board of Governors and as Chair of both the Strategy Committee and the Audit and Finance Committee•Served from April 2013 to April 2015 as a member of the Board and Finance Committee of the Board of Nevada Health Centers, a federally-qualified health center in 1990. Her last position prior to retirement wasNevada•Retired as National Managing Principal, Research & Development and Member, Deloitte & Touche USA Executive Committee in 2007, a position Ms. Raney held from 2003 to 2007. She was a member of2007•Served on the Deloitte Board of Directors from 2000 to 2003 while serving as the Human Capital E-Business Leader. She also held theLeader•Held numerous positions ofwith Deloitte & Touche USA, LLP from 1988 to 2007, including Global Leader, Integrated Health Group from 1996 to 2000;2000, and Western Regional Leader and National Co-Leader, Integrated Health Group from 1988 to 1996.1996Skills and Qualifications: The Board believes DIRECTOR QUALIFICATIONS Ms. Raney is qualifiedprovides valuable knowledge and skills to serve as a member on our Board due to her financial skills and experience in the gaming industry, as well as her statusindustry. Ms. Raney has been designated as an “audit committee financial expert.”expert” in accordance with NYSE listing standards.Atul BaliOther Directorships:INDEPENDENT, AUDIT COMMITTEE FINANCIAL EXPERTAge: Ms. Raney serves48Director Since: 2019Committees: Audit, Compensation, Nom GovBACKGROUND •Serves as non-executive Chairman of the Board of Meridian Tech Holdings Ltd., a regulated global emerging markets sports betting and online gaming firm, operating in Europe, Latin America, and Africa since 2016•Investor in, and advisor to, a range of privately held lottery, gaming, and fintech businesses, including Instant Win Gaming Ltd., a provider of mobile instant win games to State Lottery operators, and Gaming Realms PLC (LSE: GMR), a developer, publisher, and licensor of mobile games, where he served on the board of directors from 2014 to 2018 and held the position of Deputy Chairman from 2015 to 2018•Serves as a director on the Board of numerous privatelyRainbow Rare Earths Ltd. (LSE: RBW), a mining company focused on production from, and expansion of, the high-grade Gakara Rare Earth Project in Burundi, East Africa since 2017•Served as President and CEO of GTECH G2, a subsidiary of GTECH Corporation (now NYSE: IGT) until 2010, and held companies.various executive positions, including SVP Corporate Development & Strategy, SVP Commercial Services, and VP Global Business Development at GTECH Corporation between 1997 and 2010•Served as CEO of XEN Group from 2010 to 2012, and thereafter, in divisional President & CEO roles at Aristocrat Technologies Inc. (ASX: ALL) from 2012 to 2014, and RealNetworks, Inc. (NASDAQ: RNWK) from 2014 to 2015•Began his career as a Chartered Accountant with KPMGDIRECTOR QUALIFICATIONS Mr. Bali provides valuable knowledge and skills to our Board due to his extensive skills and experience in the interactive gaming, gaming, and fintech industries. Mr. Bali was previously qualified as a Chartered Accountant and has been designated as an “audit committee financial expert” in accordancewith NYSE listing standards.1011Class II Directors Whose Term Will Expire in 2020 Geoffrey P. JudgeINDEPENDENTAge: 66Director Since: 2006Committees: Audit, Compensation (Chair), Nom GovBACKGROUND •Served as a Partner at iNovia Capital, a manager of early stage venture capital funds, from 2010 to 2016 and continues to sit on boards of iNovia portfolio companies•Active private equity investor since 2002, working actively with CEOs at his portfolio companies•Served as Chief Operating Officer in 2002 of Media Solution Services, Inc., a provider of credit card billing insert media•Co-founder and Senior Vice President and General Manager from 1997 to 2002 of the media division of 24/7 Real Media•Served from 1995 to 1997 as Vice President of Marketing for iMarket, Inc., a software company•Served from 1985 to 1994 as a Vice President and General Manager in the credit card division of American Express•Holds an M.B.A. from Columbia University and a degree in economics from Northwestern UniversityDIRECTOR QUALIFICATIONS Mr. Judge provides valuable knowledge and skills to our Board due to his extensive knowledge of the Company’s business and his experience in the financial services and payments industries. Michael D. RumbolzCHIEF EXECUTIVE OFFICER, NON-INDEPENDENTAge: 66Director Since: 2010Committees: NoneBACKGROUND •Serves as our Chief Executive Officer, having previously served as our President and Chief Executive Officer since June 2016, as our Interim President and Chief Executive Officer since February 2016, and previously as an independent member of our Board from 2010 until his February 2016 appointment to the Interim President and Chief Executive Officer position•Served from 2008 to 2010 as a consultant to the Company advising on various strategic, product development, and customer relations matters following the Company’s acquisition in 2008 of Cash Systems, Inc., a provider of cash access services to the gaming industry•Served as Chairman and Chief Executive Officer of Cash Systems, Inc. from January 2005 until August 2008•Held various positions in the gaming industry, including Vice Chairman of the Board of Casino Data Systems, President and Chief Executive Officer of Anchor Gaming, Director of Development for Circus Circus Enterprises (later Mandalay Bay Group), President of Casino Windsor at the time of its opening in Windsor, Ontario, and also has provided various consulting services•Served as Member and Chairman of the Nevada Gaming Control Board from January 1985 to December 1988•Former Chief Deputy Attorney General of the State of Nevada from June 1984 to January 1985•Serves as Chairman of the Board of Directors of Employers Holdings, Inc. (NYSE: EIG), a holding company whose subsidiaries are engaged in the commercial property and casualty industry, since January 2000, but will not stand for re-election upon expiration of his current term on May 28, 2020•Serves as a member of the Board of Directors of VICI Properties Inc. (NYSE: VICI) since October 2017•Serves as a member of the Board of Seminole Hard Rock Entertainment, LLC since 2008DIRECTOR QUALIFICATIONS Mr. Rumbolz’s vast experience in, and knowledge of, the highly-regulated gaming industry, both as an operator and as a regulator, as well as his experience in the cash access business, and skills gained from previous and current public and private board service, are valuable to our Company and our Board. 12Ronald V. CongemiINDEPENDENTAge: 73Director Since: 2013Committees: Audit, Compensation, Nom GovBACKGROUND •Active member of the Philadelphia Federal Reserve’s Consumer Finance Institute•Served as a member of the Board of Directors of Clearent LLC, a merchant processing company, from 2007 to 2015•Served as consultant to the Acxsys Corporation of Canada, the operating arm of the Interac debit network of Canada from 2009 to 2011•Paid advisor to the Gerson Lehrman Group, a global advisory firm•Served as the Chief Executive Officer of First Data’s Debit Services Group (which was acquired by KKR and Co. in 2008, and subsequently by Fiserv in 2019) from 2004 until his retirement in 2009•Served as Senior Vice President of Concord EFS, Inc., a payment and network services company (which was acquired by First Data Corporation in February 2004), and Concord’s Network Services Group from 2001 to 2004•Founded Star Systems, Inc., an ATM and Personal Identification Number, or PIN, debit network in the United States (which was acquired by Concord EFS, Inc. in 2001), and served as its President and Chief Executive Officer from 1984 to 2009DIRECTOR QUALIFICATIONS Mr. Congemi is valuable to our Board due to his extensive management experience in the payments industry. 13Corporate Governance PhilosophyThe business and affairs of the Company are managed under the direction of the Board in accordance with the Delaware General Corporation Law, as implemented by the Company’s Amended and Restated Certificate of Incorporation as amended, and Second Amended and Restated Bylaws. The role of the Board is to effectively governoversee the affairs of the Company for the benefit of its stockholders and other constituencies. The Board strives to ensureguide the success and continuity of business through the selection of qualified management. It is also responsible for ensuringreviewing the Company’s compliance programs so that the Company’s activities are conducted in a responsible and ethical manner. The Company is committed to having sound corporate governance principles. Highlights of our corporate governance structure and policies include:•All of our directors are independent (other than our Interim President and Chief Executive Officer)•Entirely independent Board committees•Corporate governance guideline requires majority voting for directors•Separate Chairman and Chief Executive Officer roles•Regular executive sessions of independent directors•Anti-hedging and anti-pledging policies•Annual Board and committee self-evaluations•Director and officer stock ownership guidelines•Risk management oversight by the Board and committees•Cash and equity compensation clawback policy•Code of Business Conduct, Standards and Ethics (and related training)•Executive compensation based on pay-for-performance philosophy•Formal Board process for executive succession planning•Absence of stockholder rights (poison pill) plan14 15